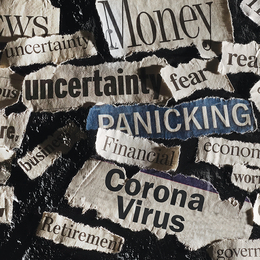

It’s no secret that the pandemic created a financial crisis in this country, and now with rising inflation, supply chain issues and other determining factors, the nation’s economy continues to find itself in troubling times. That uncertainty is causing investors worry, especially those closer to retirement who are watching the volatile market closely.

To find out how to best weather the storm, we spoke with some of the area’s leading financial planning experts to get tips and advice for the best way to move forward.

What’s the best way for one to identify their risk tolerance and best allocate their assets?

Do not base your asset allocation strategy on trying to predict the future. As we continue to tell clients—it’s better to prepare for the future than try to predict the future. We always try to hope for the best but prepare for the worst—especially in today’s economic and political environment.

One of the research firms that we use, The Stansberry Digest, has constantly mentioned that we should all know our “uncle” point—your real risk tolerance level. As long as you and your advisor have established that “uncle point,” and as long as you have the ability to create plenty of cash buy knowing your exit strategy on various assets, you should be in decent shape.

Stan Molotsky, president and CEO, SHM Financial Group

How are factors like the pandemic and inflation impacting one’s retirement plans, and how do the challenges differ if someone is closer to retirement vs. still in the middle stages of their career?

Ebbs and flows in the market are typical; historically they happen with regularity. The further you are from retirement, the more time you have to recover from any down cycle in the market. As you get closer to retirement, you have less time to recover, so typically people will tend to be more conservative as they get closer.

When you are in the higher earnings phase of your career, you have more years to add into your retirement and recover, so you can still make a good plan for adding money in. It’s important to note that when these down cycles happen, we know with 100% certainty that the market always comes back. But financial advisors can’t predict when that will recovery will happen or how quickly.

Kelli Brack, financial advisor, Edward Jones

Published (and copyrighted) in Suburban Family Magazine, Volume 13, Issue 2.

For more info on Suburban Family Magazine, click here.

For information about advertising in Suburban Family Magazine, click here.

To find out where to pick up your copy of Suburban Family Magazine, click here.